- MyActuary Newsletter

- Posts

- Actuaries in the Age of Planetary Risk: Rethinking Models for a Warming World

Actuaries in the Age of Planetary Risk: Rethinking Models for a Warming World

The age of planetary risk has arrived, and actuarial models must evolve to keep pace. From resource scarcity to transition shocks, this piece examines how environmental dynamics are transforming the science of risk.

Table of Contents

Overview

The global risk landscape is being rewritten by environmental change. What were once isolated climate incidents have coalesced into a persistent backdrop to every demographic, economic, and financial projection. For actuaries, this shift represents more than a new risk class, it is a new modeling paradigm. From resource depletion and biodiversity loss to transition shocks in carbon-intensive sectors, environmental dynamics now shape mortality, morbidity, asset valuation, and solvency itself.

The actuarial discipline must evolve from measuring volatility to interpreting the systems from which volatility emerges.

Natural Resource Scarcity and Systemic Exposure

Modern economies are built on finite natural foundations, water, food, and energy. Demand now grows faster than replenishment, driven by urbanization, industrial farming, and climate extremes. Falling water tables, salinized soils, and disrupted food chains have moved resource scarcity from environmental science into actuarial balance sheets.

Shortages ripple through every risk model: crop failures inflate food prices, malnutrition alters morbidity trends, and migration reshapes population assumptions in life and pension projections. Even property insurance is affected as drought and subsidence undermine land values and infrastructure.

To remain credible, actuaries must integrate dynamic feedback loops linking environmental stress, behavioral response, and policy adaptation into their exposure frameworks.

Interested in advertising with us? Visit our sponsor page

Financial Reverberations of Climate Events

Environmental shocks now echo across both sides of the balance sheet. Floods, hurricanes, and heatwaves not only trigger claims but also devalue collateral and assets. On the liability side, catastrophe reserves swell as reconstruction drags on. On the asset side, bonds tied to exposed industries lose value, while real estate prices bifurcate along resilience lines.

The once-diversifying relationship between assets and liabilities is eroding. Reinsurers in vulnerable regions have already repriced risk, passing volatility into local markets. For actuaries, the challenge is to model persistence, the duration over which climate shocks continue to distort financial equilibrium.

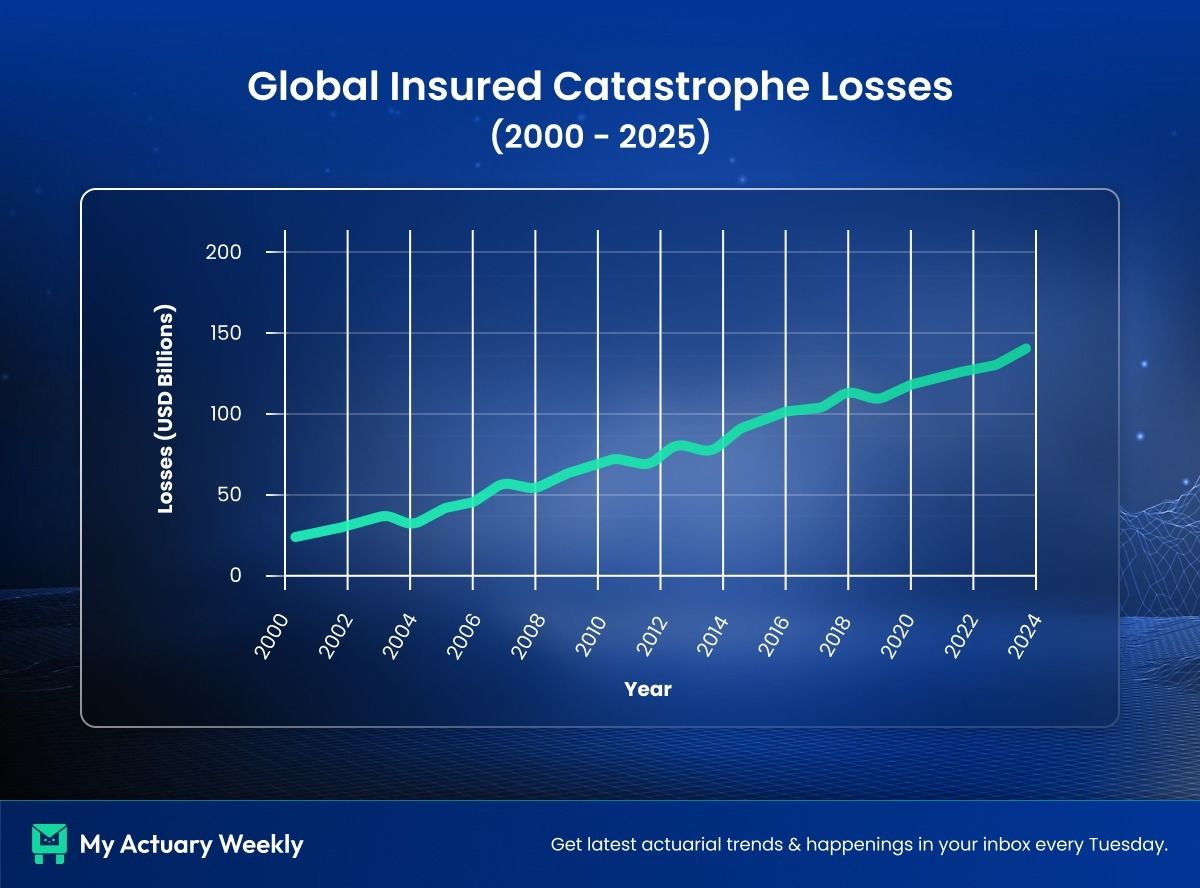

The Escalation of Catastrophe Losses

Extreme weather has become both predictable and unpredictable: certain to occur, uncertain in form. Global insured catastrophe losses have doubled within a decade, even after inflation adjustment. Urban floods, wildfire seasons, and storms are breaching historical boundaries.

Actuarial loss triangles: anchored in history, are struggling to stay relevant. The shift is toward forward-looking catastrophe models based on geospatial and meteorological data. Yet even these depend on climate-science projections that carry deep uncertainty.

The implication is clear: pricing volatility and capital strain are here to stay. Insurers who rely on outdated averages risk underpricing exposure or retreating from entire regions, widening the protection gap. The actuary’s task expands, safeguard solvency, but also inform public adaptation and resilience strategy.

While climate extremes grab attention, slower degradations, polluted air, contaminated water, declining ecosystems, undermine health and productivity in ways that quietly distort actuarial baselines. Biodiversity loss amplifies volatility in food supply, disease patterns, and income stability.

The collapse of natural regulators like wetlands and forests transforms ecological fragility into financial fragility. These risks do not appear independently; they compound across portfolios. A failed monsoon can simultaneously trigger crop, health, and credit losses.

For actuaries, this calls for cross-sector modeling, recognizing that life, health, agricultural, and credit risks share environmental DNA.

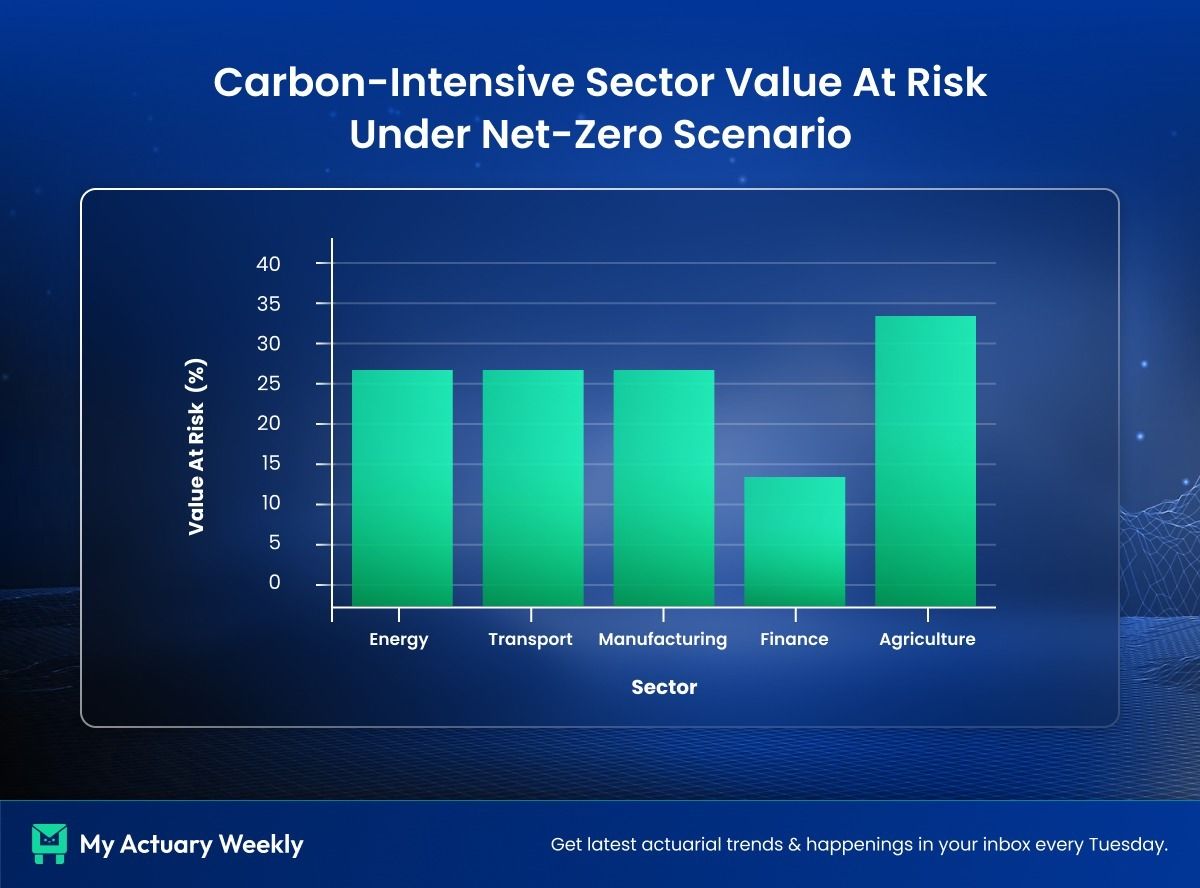

Transition Risk in the Low-Carbon Economy

The journey toward net-zero emissions introduces its own uncertainty. As governments tighten carbon policies and technologies evolve, asset valuations shift abruptly. Carbon-heavy sectors may face stranded assets, litigation, and rapid repricing.

Life insurers, pension funds, and sovereign investors must account for these transition dynamics in their valuation bases. A single policy change: a carbon tax, a ban, a subsidy can reshape projected cash flows.

In emerging markets, the stakes are existential: economies reliant on coal or oil exports risk fiscal instability if diversification lags. Actuaries must now incorporate transition trajectories into national solvency and sustainability projections.

Data, Uncertainty, and the Modeling Frontier

Environmental risk destabilizes the statistical scaffolding of actuarial work. Historical data is insufficient; correlation structures fluctuate; causal chains are complex. The future belongs to hybrid methods: stochastic climate scenarios, agent-based models, and geospatial analytics integrated into actuarial engines.

Equally important is how actuaries communicate uncertainty. Decision-makers crave precision, but environmental risk defies single-point estimates. Professional integrity lies not in false certainty but in transparent assumptions, scenario ranges, and clear explanation of model limitations.

A Redefined Professional Mandate

Environmental risk is no longer an externality; it is the environment within which every other risk now unfolds. Actuaries, custodians of long-term stability, must adapt their tools and ethics to this planetary context.

Water scarcity, pollution, biodiversity collapse, and carbon transition are not parallel crises; they are interconnected expressions of one planetary system under stress. The actuarial profession’s next evolution will depend on its ability to integrate these dynamics, quantify them responsibly, and advise with foresight rather than hindsight.

Last week we covered Reinsuring Capital: The Quiet Engineering of Solvency in Life and Health Insurance.

👉 If you missed the last week’s issue, you can find it here.

🌟 That’s A Wrap For Today!We’d love your thoughts on today’s newsletter to make My Actuary Weekly even better. Let us know below: |

Pulse For the Week

Have you signed up to our weekly job alerts on Actuary List? We post 50 new handpicked jobs every week that match your expertise. To ensure you don’t miss out, sign up here. Here are a few examples of new jobs this week:

👔 New Actuarial Job Opportunities For The Week

💼 Sponsor Us

Get your business or product in front of thousands of engaged actuarial professional every week.

💥 AI Prompt of the Week

About This Prompt

Generates a pros-and-cons list for a business decision. This prompt helps in decision-making communication by outlining advantages (e.g. improved efficiency, scalability) versus disadvantages (cost, learning curve) of moving to a new tool. It can serve as a starting point for an actuary’s recommendation memo or discussion with management.

The Prompt:

“Our team is considering switching from our Excel-based valuation system to a new actuarial software. List the potential benefits and drawbacks of making this switch.”

🏆 Featured Actuary Of The Week

| Managing Director, KR Service Limited, Trinidad & Tobago With more than three decades of experience spanning life, health, pensions, and general insurance, Kyle Rudden has built a career at the intersection of actuarial science, accounting, and sustainability. Based in Trinidad & Tobag. |

He leads KR Services Limited, a regional consultancy supporting clients across the Caribbean, Latin America, and Africa. Under his leadership, the firm has become known for bridging global standards with local realities - helping insurers, regulators, and financial institutions implement IFRS, strengthen risk management, and embrace sustainability-focused actuarial practices.

Kyle’s career has been defined by his passion for making actuarial work practical and globally relevant. His leadership in adapting international accounting and regulatory frameworks for developing markets reflects his deep commitment to progress in emerging economies. Beyond client work, Kyle actively gives back through mentoring actuarial students, volunteering with professional bodies, and sharing his knowledge worldwide. His advice to the next generation is simple yet powerful: stay curious, stay versatile, and don’t box yourself into traditional actuarial roles - the future of the profession lies in those willing to explore new frontiers.

💻 Actuary Tool of the week

An end-to-end data science platform that can streamline the entire modeling process for actuaries. Dataiku provides tools for data preparation, modeling (including machine learning), and deployment in one environment. It’s designed to help actuaries handle large, complex data and develop advanced models more efficiently. For instance, an enterprise risk management team might use Dataiku to aggregate data from various risk systems and build scenario models, all within a collaborative platform that doesn’t require each step to be coded from scratch.