- MyActuary Newsletter

- Posts

- Hidden Hazards: Unveiling the Dark Side of Big Data - And Why Actuaries Should Care

Hidden Hazards: Unveiling the Dark Side of Big Data - And Why Actuaries Should Care

What if the biggest risks in today’s data-driven world aren’t financial at all, but the invisible forces shaping how we think, decide, and model?

Table of Contents

Algorithms Are Quietly Rewriting Human Thinking

Algorithms increasingly shape how individuals think and act. This isn’t just a societal concern-it's a professional one. Actuaries, whose work relies heavily on data, models, and analytics, now operate in an environment where ethical considerations are lagging behind technological power.

Advertising, consumer analytics, and behavioral targeting reach deeper into human psychology than ever before. In this era of information overload, even technical professionals risk becoming passive recipients of algorithmic decisions unless they intentionally think critically about data, assumptions, and model outputs.

For actuaries, the message is clear:

Data is powerful-but without ethics, transparency, and governance, it can mislead, distort, or harm.

Surveillance, Manipulation & the Changing Data Landscape

The Vault 7 WikiLeaks revelations demonstrated that innovation has outpaced society’s defensive capabilities. Smart devices-from phones to cars to TVs-were shown to be vulnerable to hacking.

This matters for actuaries because:

We rely on data integrity

We utilize interconnected systems (e.g., cloud platforms, vendor tools, APIs)

We produce sensitive outputs that influence capital, pricing, and reserving decisions

As Orwell’s 1984 and Foucault’s Panopticon warn, surveillance and data misuse are not abstract threats. They are real factors shaping consumer behavior, regulatory scrutiny, and enterprise risk.

Public relations firms “manufacture consent” (Chomsky), and Cambridge Analytica demonstrated how behavioral data can be weaponized.

For actuaries:

This raises questions about model fairness, data provenance, bias, and how organizations may use actuarial outputs in broader decision-making ecosystems.

Newsletter continues after job posts…

👔 New Actuarial Job Opportunities For The Week

Have you signed up to our weekly job alerts on Actuary List?

We post 50 new handpicked jobs every week that match your expertise. To ensure you don’t miss out, sign up here. Here are a few examples of new jobs this week:

Interested in advertising with us? Visit our sponsor page

Innovation Outpacing Ethics - A Direct Challenge to Actuarial Governance

Karl Marx’s observation that modern economies constantly revolutionize their tools applies perfectly to today’s analytics landscape. New data sources, new modeling platforms, LLM-powered tools, and increasingly automated pipelines are transforming actuarial workflows.

But innovation without governance creates risks:

Outputs may embed bias

Automated decisions may bypass traditional actuarial judgment

Black-box algorithms may challenge ASOP compliance

Regulators may react after the fact, not before

Actuaries, by code of professional conduct, must ensure models are explainable, reproducible, and fair.

That responsibility becomes harder as tools grow more opaque.

Big Data Isn’t Neutral - How Inequality and Bias Enter Models Actuaries Use

Cathy O’Neil’s Weapons of Math Destruction illustrates how biased data leads to biased models. We see parallels in actuarial work:

Credit scores and ZIP codes can perpetuate racial inequality in insurance pricing

Historical underwriting data may embed discriminatory patterns

Gender-based pricing (allowed in some jurisdictions, banned in others) reflects how actuarial models intersect with societal norms and ethics

ML-driven fraud detection or underwriting may inadvertently over-select certain demographics

The actuarial profession prides itself on fairness, but fairness cannot be assumed-it must be designed, tested, documented, and monitored.

Bubble Rationality and the Actuary’s New Reality

The rise of “bubble rationality”-where individuals live in self-curated informational universes-matters for actuaries in two critical ways:

Consumer behavior becomes harder to model.

Pricing, lapse assumptions, persistency behavior, and product preferences may diverge sharply across digital bubbles.Stakeholders may interpret data selectively.

Management, regulators, auditors, and distribution channels may each operate in their own narrative ecosystem-each armed with “data” that reinforces their viewpoint.

Actuaries must be the translators-bringing objectivity, context, and critical thinking to a fractured data environment.

The Disappearance of Critical Thinking (And Why It Matters for Actuaries)

Modern work life-fast, busy, distracted-makes deep thinking rare. But actuarial work requires deep thinking:

Model risk increases when actuaries rush

Assumption-setting becomes mechanical instead of judgment-based

Processes follow habit rather than analysis

Important questions (“Does this make sense?”) get skipped

Socrates warned against “barren busyness.” Russell praised leisure as a condition for thought. Buddha emphasized inner inquiry.

The actuarial version: Good actuarial work requires time, reflection, and skepticism.

Actuaries in the Knowledge Society and Risk Society

Knowledge Society

Actuaries operate in a world where knowledge-not labor or capital-is the primary economic engine. Every model update and assumption set becomes a knowledge artifact.

Risk Society

Ulrich Beck’s description of the risk society perfectly aligns with the actuarial domain:

Financial contagion

Climate change

Systemic risk

Cyber risk

Operational risk

Longevity and health crises

Geopolitical shocks

Actuaries sit at the intersection of knowledge and risk-responsible for quantifying and communicating uncertainty in a world that grows more uncertain every year.

ESG, Big Data, and the Risk of Ethical Blind Spots

As companies race to meet ESG expectations, actuaries will be increasingly involved in:

Climate modeling

Scenario analysis

Portfolio risk assessments

Measuring social and governance risks

Supporting sustainable insurance and investment strategies

But if big data can distort reality-or camouflage unethical practices-ESG measurement becomes unreliable.

Actuaries need to ask:

Is the data behind ESG metrics reliable?

Is there selective reporting?

Are algorithms influencing ESG scoring fairly?

Could models unintentionally greenwash?

ESG is only as strong as the honesty of the data behind it.

Key Takeaways for Actuaries

Data Without Ethics Becomes Dangerous

Your role increasingly includes evaluating fairness, bias, and model transparency-not just technical accuracy.Actuaries Must Strengthen Model Governance

As models become automated and opaque, traditional governance needs reinforcement.Bias Can Hide Inside Historical Data

Actuaries should critically evaluate whether their inputs reflect structural inequities.The Profession Must Adapt to Bubble Rationality

Consumer assumptions are diverging; models must reflect a more fragmented behavioral landscape.ESG Requires Actuarial Skepticism

ESG metrics are vulnerable to manipulation; actuaries must ensure integrity and reliability.Critical Thinking Is the Actuary’s Most Important Tool

Amid automation and AI, the value of actuarial judgment increases-not decreases.

ESG Data Reliability By Category

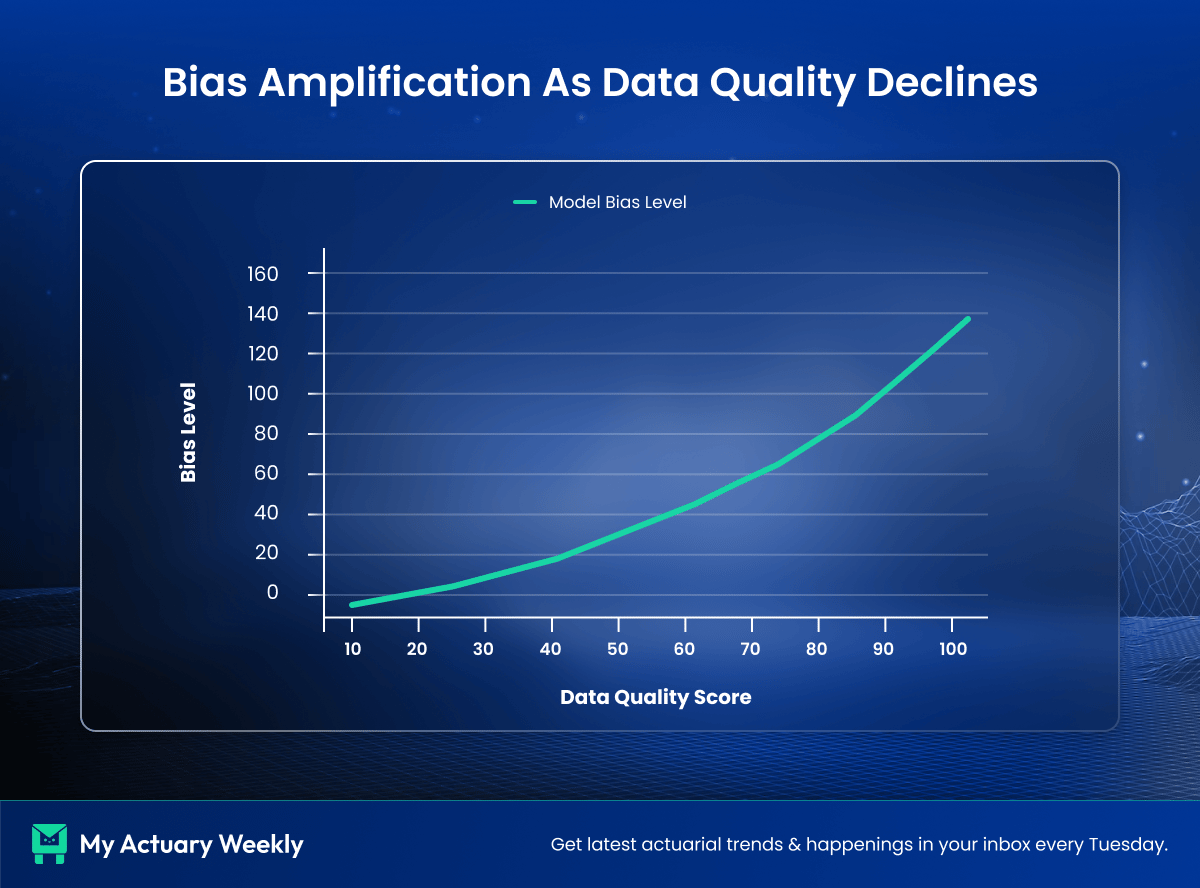

Bias Amplification As Data Quality Declines

Closing Thought

Big data is powerful, transformative, and filled with opportunity. But without reflection, critical thinking, and ethical boundaries, its darker side can undermine trust, fairness, and societal stability.

Actuaries-guardians of risk and integrity-have a unique responsibility to ensure that the future of data serves humanity, not the other way around.

Last week we covered Innovation, Flexibility, and the Future of the Actuarial Profession.

👉 If you missed the last week’s issue, you can find it here.

Pulse For The Week

💼 Sponsor Us

Get your business or product in front of thousands of engaged actuarial professional every week.

💥 AI Prompt of the Week

About This Prompt

Creates a checklist for peer review-helping teams ensure governance, model integrity, and clean sign-offs. Reduces the risk of missing material items during oversight reviews.

The Prompt:

Summarize the key items a peer reviewer should focus on for this model or analysis. List potential red flags, data considerations, controls, and materiality thresholds.

💻 Actuary Tool of the week

Google Gemini

Meet Gemini, Google's AI assistant. Get help with writing, planning, brainstorming, and more. Experience the power of generative AI.

🌟 That’s A Wrap For Today!We’d love your thoughts on today’s newsletter to make My Actuary Weekly even better. Let us know below: |