- MyActuary Newsletter

- Posts

- When Society Becomes a Risk Factor: The Actuarial Reality of Social Inflation

When Society Becomes a Risk Factor: The Actuarial Reality of Social Inflation

In the past decade, loss triangles have begun to tell a social story. What was once purely numerical is now cultural, where shifting public attitudes, jury behaviors, and litigation finance reshape the very pattern of loss development.

Table of Contents

An Old Concept Returns to Centre Stage

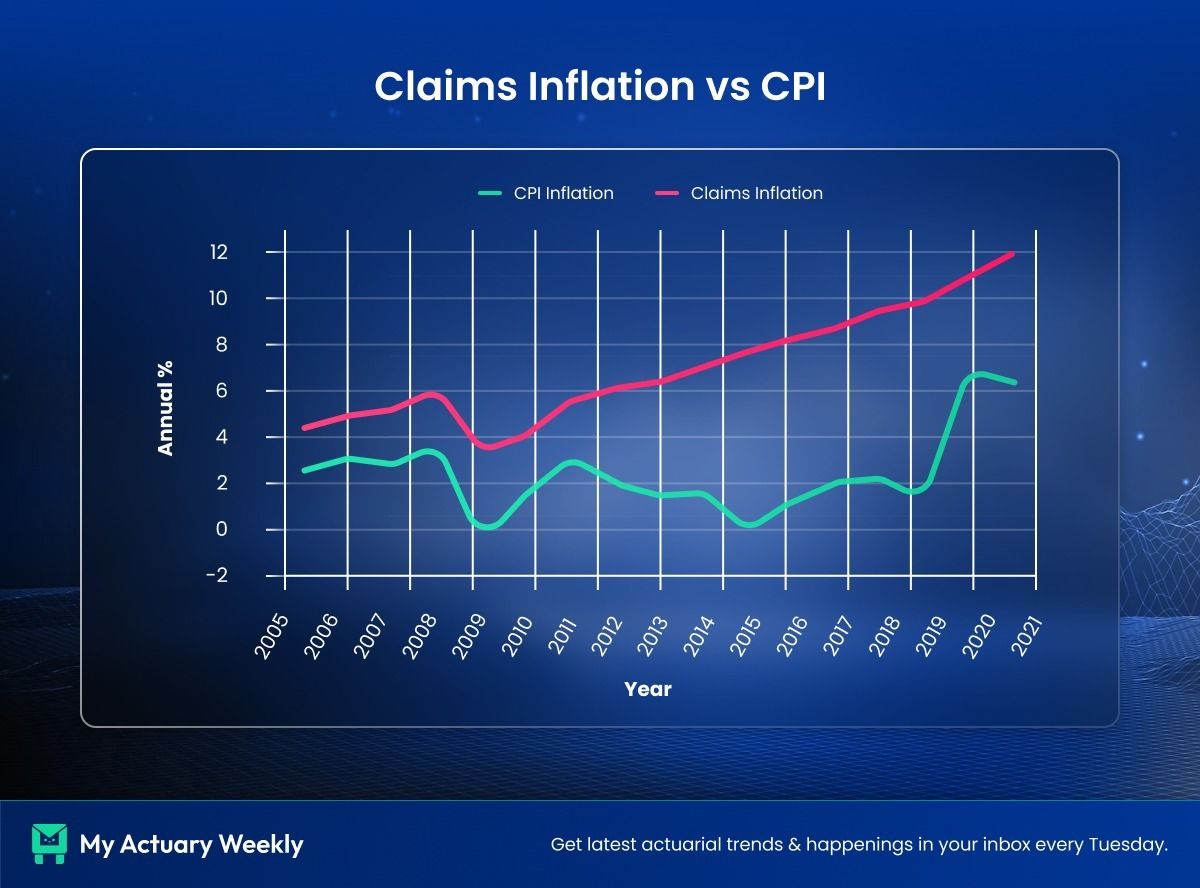

When Warren Buffett first popularized the term social inflation in the late 1970s, he described a subtle but powerful force: society’s expanding notion of what constitutes “fair” compensation in liability cases. Half a century later, the phrase has re-entered actuarial vocabulary with renewed urgency. Across multiple jurisdictions, loss costs in long-tailed liability lines are rising far faster than either consumer prices or economic growth.

Recent studies by the Casualty Actuarial Society confirm that this is not a perception issue or a temporary pricing cycle. Between 2010 and 2019, social inflation added more than $20 billion to U.S. commercial auto liability losses; and the effect continues to compound. What began as a legal trend has now become a structural driver of underwriting results.

Seeing the Signal in the Loss Triangle

The clearest actuarial evidence lies within the loss-development triangle. Actuaries depend on the interaction of accident, development, and calendar years to forecast ultimate losses. When development factors shift consistently across multiple diagonals, the message is unmistakable: the claims environment has changed.

CAS researchers tracked the cumulative 12-to-60-month development factors for commercial auto liability. Beginning around 2010, those factors rose sharply, breaking the stability observed in earlier decades. Losses were maturing faster, and to higher ultimate levels, than models had anticipated.

By benchmarking these outcomes against nominal GDP, analysts could isolate the portion of severity growth unrelated to exposure or economic inflation. The residual drift pointed to tens of billions in extra costs, echoed more moderately in medical malpractice and other liability lines. Even in shorter-tailed classes like personal auto, the same upward direction was evident despite frequency volatility and catastrophe effects.

Interested in advertising with us? Visit our sponsor page

The Pandemic Pause, and the Return to Pressure

Data through 2021 seemed to offer relief: development factors fell to levels last seen in 2016 and 2017. But this “improvement” was an illusion born of pandemic disruptions. Court closures, postponed trials, and delayed settlements temporarily froze the litigation pipeline.

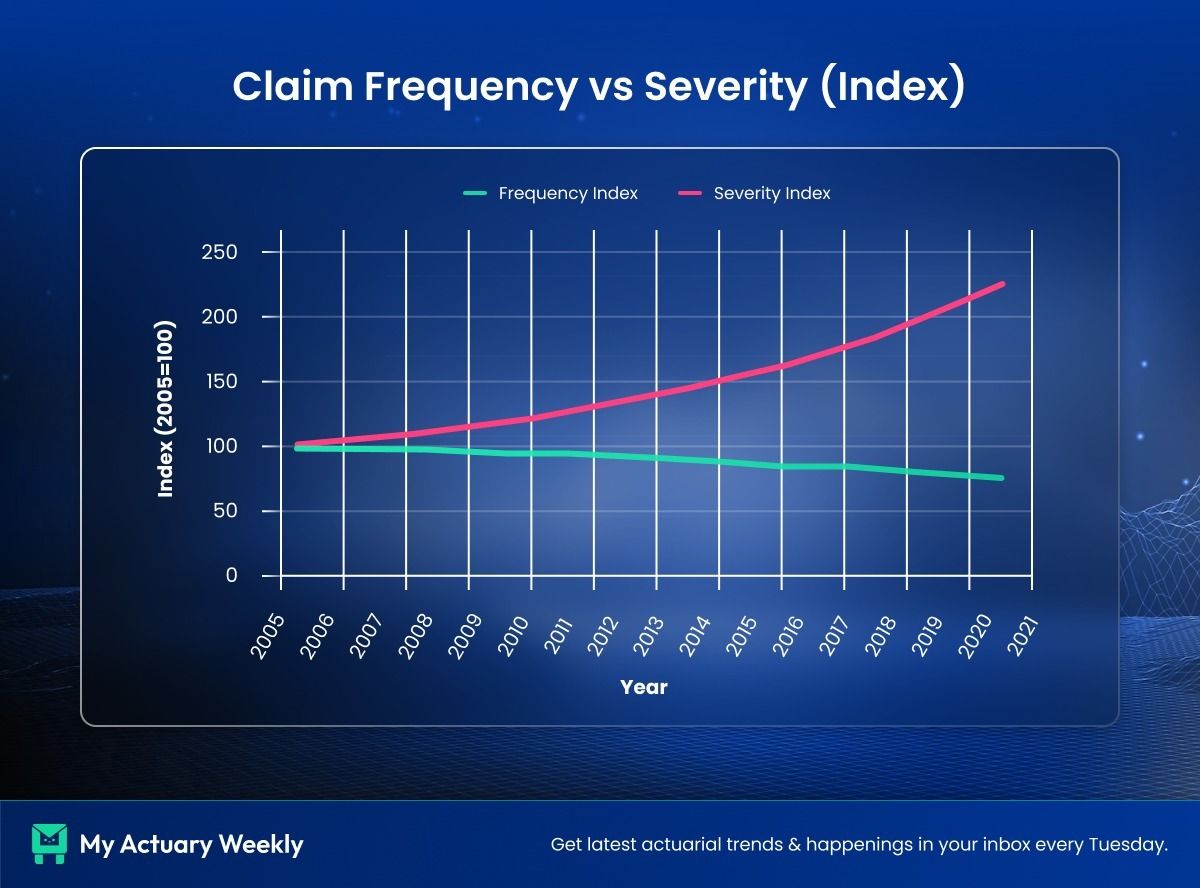

Once restrictions lifted, severity rebounded with remarkable speed. By 2021, median jury awards in large cases were already nearing pre-COVID peaks. Claim frequency fell with reduced mobility, yet each claim that did emerge proved substantially more expensive. Supply-chain disruptions, medical inflation, and labour shortages played a part, but the deeper force was behavioural. Jurors, newly returned to courtrooms, displayed heightened sensitivity to perceived negligence and corporate indifference.

The result: a landscape of lower frequency but escalating severity, a scenario that confounds traditional chain-ladder assumptions and exposes the fragility of models calibrated on historical averages.

Behavioural Drivers Behind the Numbers

Social inflation is not one phenomenon but a confluence of behavioural and institutional changes. CAS analyses highlight several structural shifts:

Tort-reform rollbacks that removed caps on noneconomic damages.

Third-party litigation funding, now a multibillion-dollar global industry, allowing investors to back lawsuits for profit.

Aggressive attorney advertising that transforms mass torts into consumer campaigns.

Social-media amplification of corporate mistrust and sympathy for plaintiffs.

Together, these have reshaped negotiation baselines and jury expectations. Even cases that never reach trial are influenced by the threat of “nuclear verdicts.” Settlement amounts across the entire distribution edge upward, generating a systematic rise in severity that traditional inflation assumptions cannot explain.

Court backlogs add another layer: when trials are delayed, inflation compounds during the waiting period, inflating indemnity costs and forcing insurers to hold larger reserves. What looks like volatility in loss triangles often reflects these social and procedural dynamics rather than random statistical noise.

Implications for Actuarial Practice

Social inflation challenges the foundational actuarial assumption that the past is a reliable predictor of the future. Its effects ripple through pricing, reserving, and capital management:

Monitoring calendar-year effects: Calendar-year link ratios and variances are more responsive to external shocks than accident-year metrics.

Integrating external indicators: Models should incorporate proxies such as litigation frequency, media sentiment, and regulatory reform indices.

Using stochastic simulations: These better capture tail volatilities and the widening range of plausible outcomes.

Qualitative intelligence: Collaboration with claims and legal teams can surface early warning signs, shifts in jury behaviour, funding trends, or judicial bottlenecks, before they appear in data.

From a capital perspective, longer claim tails and heavier severity distributions widen the solvency margin required for resilience. Scenario testing under sustained social-inflation conditions can reveal hidden exposures and strengthen enterprise-risk frameworks.

Beyond the Models

Ultimately, social inflation blurs the line between actuarial science and social science. It is not a transitory distortion but a mirror of societal change; how communities interpret fairness, accountability, and corporate responsibility.

For actuaries, the challenge is to extend analytical rigor into this human domain. The profession’s value lies in transforming complex behavioural signals into measurable risk parameters that support sound policy and pricing.

Loss development, viewed through this lens, becomes more than a mechanical progression of numbers: it is a record of evolving social judgment. Every uptick in the triangle carries information about the public’s shifting sense of justice.

To recognize that is not to abandon actuarial discipline, it is to broaden it. Social inflation reminds us that every model operates within a society and understanding that society is part of understanding the risk itself.

Last week we covered Actuaries in the Age of Planetary Risk: Rethinking Models for a Warming World.

👉 If you missed the last week’s issue, you can find it here.

Pulse For The Week

Have you signed up to our weekly job alerts on Actuary List? We post 50 new handpicked jobs every week that match your expertise. To ensure you don’t miss out, sign up here. Here are a few examples of new jobs this week:

👔 New Actuarial Job Opportunities For The Week

💼 Sponsor Us

Get your business or product in front of thousands of engaged actuarial professional every week.

💥 AI Prompt of the Week

About This Prompt

Simulates a mock interview prep session. ChatGPT will list likely questions – both technical and behavioral – and give pointers on answering. This helps actuaries prepare concise and impactful responses, increasing confidence for the real interview.

The Prompt:

“I have an interview next week for a senior actuarial analyst role (insert the position you’re interviewing for here). What are 5 common interview questions I should practice for this position, and what does a strong answer look like for each?”

🏆 Featured Actuary Of The Week

| Based in New York City, Andy Gordon leads work in the individual life and annuity space, with experience spanning group life and executive benefits products. He works out of Hudson Yards and lives on the south shore of Long Island in Bellport. |

A defining moment in Andy’s journey came on October 28, 2004, the day he passed his final actuarial exam while mourning the loss of his father. Balancing grief, new fatherhood, and career demands shaped his perspective on resilience and gratitude, lessons he carries to this day.

Andy believes the actuarial profession rewards perseverance and a love of learning. Coming from a family without college education, he credits his success to the power of education and hard work. He’s optimistic about the future of insurance and believes actuaries have a key role in driving innovation.

Outside of work, Andy lives to surf, play tennis, and spend time outdoors with his wife, Annemarie, and their three daughters. He also co-founded The Fire Place Initiative, a nonprofit in Bellport that connects under-resourced communities with nature through recreation and art.

💻 Actuary Tool of the week

Alteryx ONE is an end-to-end, AI-powered analytics platform that unifies data preparation, automation, and advanced analytics in a single environment. It enables users to blend, cleanse, and transform data without coding while integrating seamlessly with cloud and on-premise systems.Powered by generative AI, it helps analysts and business users accelerate insight generation and decision-making.From data discovery to deployment, Alteryx ONE turns complex analytics into repeatable, governed, and scalable workflows.

🌟 That’s A Wrap For Today!We’d love your thoughts on today’s newsletter to make My Actuary Weekly even better. Let us know below: |